Documents you need to be prepared to submit to The Mortgage Lady are:

Application Process

– Your last full months worth of pay stubs with a year to date total

– Your last 2 years W2s for all jobs. If you have changed jobs be prepared to give a timeline for start and stop dates.

– Your last 2 months bank accounts for checking and savings

– A picture of your driver’s license

– If you are self-employed, or if you are hoping for a USDA or THDA loan with no money down, we will need your last 2 years tax returns. If you own a business and have business returns we may need those as well.

– For VA loans we will need your DD-214. (All of them if you have more than 1)

– A mortgage statement from any home you own now that you wish to retain after closing.

– Contact information for your preferred homeowners insurance agent. If you do not have one, we can help you with a few referrals.

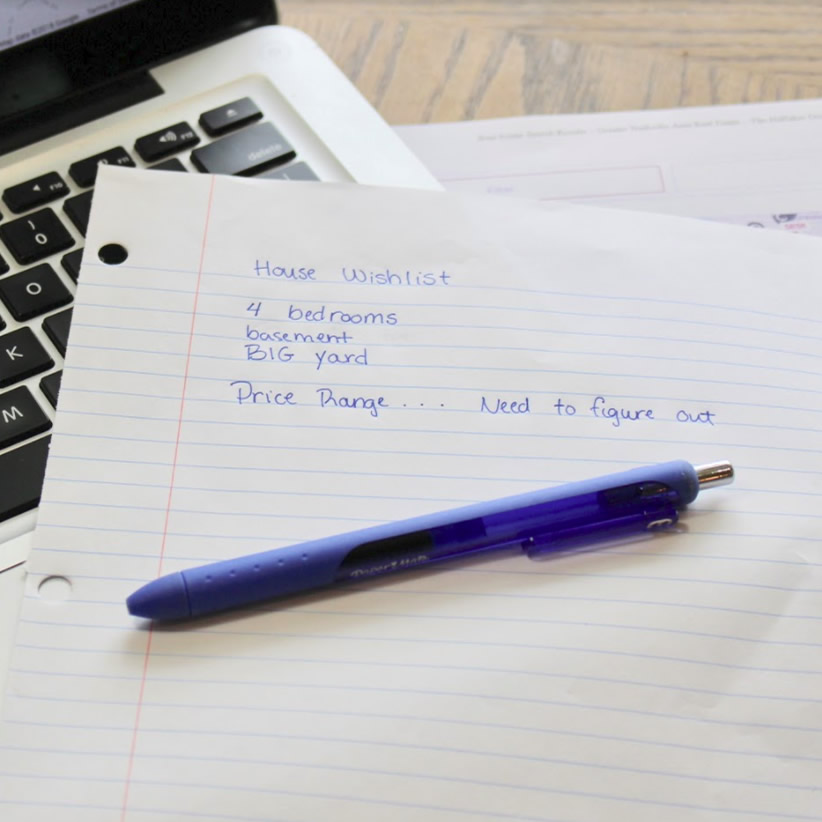

Pre-Qualification – The 1st step

Pre-Qualification is a more “lightweight” look at a client’s credit report, pay stubs and other financial documents by a Mortgage Loan Officer. It is a very important step, but it is not going to give a full picture. The pre-qualification process is often where many people and their realtors stop prior to shopping for a new home, but in our opinion, that is a mistake. Many sellers and their agents may accept a pre-qualification letter, but they don’t carry the same weight as a true pre-approval and in a head to head competition for a property with a While a client may look good on paper via the pre-qualification, there is not the same depth. The Mortgage Lady always starts with her own pre-qualification for a client but encourages new home buyers and realtors to use this as the first step that gets everyone on the same page for loan product direction and options.

Pre-Approval – The 2nd BIG STEP

A loan Pre-Approval sets you up for a smoother and less stressful home buying experience. It gets much of the most difficult portions of the loan out of the way prior to finding a property. The Pre-Approval process involves the client actually signing their loan documents for an amount they qualify for, but for a property “to be determined”. To receive a Pre-Approval, the Mortgage Lady submits your file to the lender for actual underwriting. Paystubs, W2s, in some cases actual tax returns and bank statements are all given to the underwriters the same way we would a file that had a signed sales contract. The underwriter goes thru all details and then issues a “Conditional Approval”. This approval may ask for a little extra documentation, but the “conditions” remaining usually are: 1) Find a home and sign a sales contract, 2) get an appraisal, 3) order and receive clear title and 4) secure homeowners insurance. When a seller and their realtor see one of our Pre-Approvals, it spells out very clearly that this file has been underwritten. That should put your heads above other offers on a property with only a Pre-Qualification. There is a greater level of security and assurance for the person selling the home that this sale will close. Pre-Approved clients and their realtors get more sales contracts awarded.

Get a licensed and knowledgeable Realtor involved – Step 3

Your choice of Realtor is very important. While many may be tempted to “go it alone” or look at only For Sale by Owner homes, hoping to get a “deal”, that usually ends up costing you more either during the purchase or soon after. Did you know that if you work with a realtor of YOUR choice, the SELLERS pay for their fees at closing? How great is that! It is so important for a client to have a Realtor with THEIR BEST INTEREST at heart. It is always better to have your own than just “use the one the seller is using”. If you do not have a Realtor or are unsure how to find one that is the right fit for you and your goals, just ask The Mortgage Lady or go to our Trusted Partners section of the website. We have contact information for several realtors listed or can give you some options during our application interview.

We will then provide your realtor with the Pre-Approval letter that gives them what they need to make an offer on a property within your budget. Your Realtor, your Mortgage Professional and your choice of Title companies form a team to get you into the home of your dreams with as little stress for you as possible. We know which title companies offer great service in the area and can help you and your realtor make an excellent choice for all.

FIND YOUR HOUSE and sign a sales contract – Step 4

Once your mortgage professional has a signed sales contract with you and your realtor, title and an appraisal are immediately ordered and we move thru the process to closing day.